Since 1992, taking money into Pakistan has been easy and there have been no questions asked on the source. But taking money out of the Pakistan through legal channels has remained an arduous task. Meanwhile, the informal channels remain unabated.

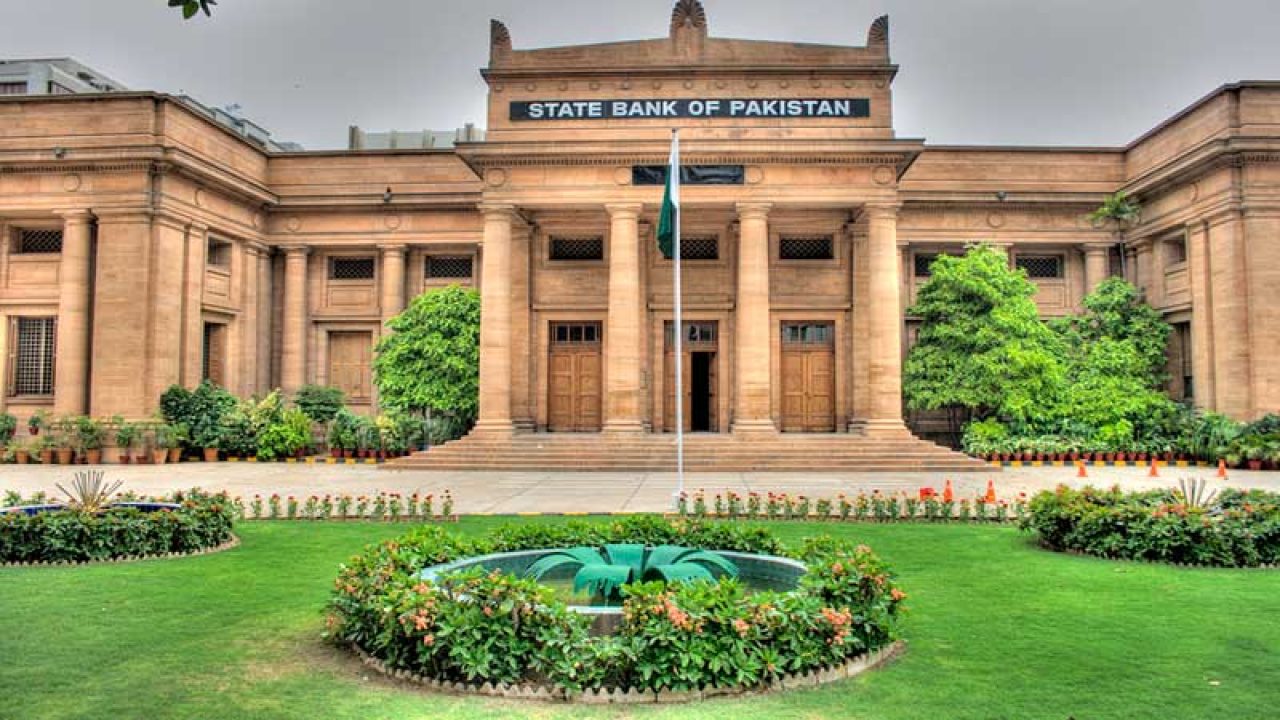

The good news is that SBP is opening up channels for money to be taken out. The limits of money to be sent aboard without asking any question is envisaged to increase by 10 times. There is a draft policy of investment abroad uploaded on the SBP website.

Investment to be allowed is subject to a few conditions based on receiving country’s regime, and the funds to be sent should be legitimate and tax paid. The investor should have a clean lending record in Pakistan. There should be no ML or TF related investigation against the sender. The point is that if you or your company is clean, you can enjoy the benefits.

This regime will surely help exporters to invest in new and existing markets to gain higher market share. The upper limit of investment abroad per year should not be more than 10 percent of one’s average annual exports of past three years. The maximum limit without involvement of SBP is set at $100,000. There are number of other conditions which can be seen on the SBP website. Similarly, relaxations are sought in case of opening up of holding companies abroad for raising capital from abroad.

When these regulations of investment abroad and disinvestment from Pakistan were extremely tight, the usual practice for companies was to register outside Pakistan and the proceeds were kept outside for investment there and startups were being registered there for attracting venture capitalist firms. Due to tight controls, the investment in Pakistan could not come anywhere near its potential.

The liberal foreign exchange movement regime which would allow money to repatriate easily can effectively attract higher money inside as tight controls have resulted in that money to invest and disinvest outside the Pakistan’s jurisdiction.

Some say that conditions are being relaxed but it is still not a fully flexible or free regime. That is correct. The argument for opening this market slowly is similar to gradual transition towards flexible exchange rate regime – today SBP is not driving the market value but is closely monitoring and intervening only to curb volatility. Similarly, the opening up of investment/disinvestment regime is to curb volatility.

The volatility is a killer till the SBP foreign exchange reserves are flirting around the critical levels. Once the reserves are up – say 5-6 months of import cover – at least, and sustain there for some time, then the SBP could be more liberal in its approach.