NSO are sometimes granted to contractors. Section 19 of the Income Tax Ordinance 2001 relates to speculation business. Speculation business pertains to sale or purchase of stocks and shares otherwise than by actual delivery or transfer of the same. Per this section, the contractor would have to declare these shares at the time he/she actually disposes them off and he/she would then pay tax on such sale of shares. However in case contractor also receives a dividend or bonus shares periodically then it is necessary to report the shares at the time of their issuance and he would also require to pay tax on such dividend.

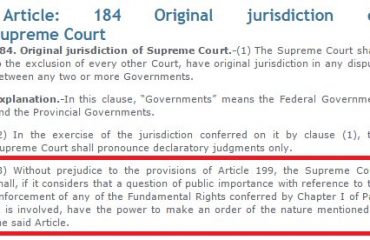

Section 14 of the Income Tax Ordinance 2011 provides that the value of a right or option to acquire shares under an employee share scheme granted to an employee shall not be chargeable to tax. However the employee is required to include the fair market value in its salary and pay tax thereon in the financial year in which shares issued and at the time of disposal of shares tax is charged on the differential amount of the value of the shares acquired and the consideration received at the actual time of sale of the shares.